I ate dinner last night in the company of Lithia Auto Dealers employee. Among other things, I asked him about that program of not negotiating on the sticker price that I had heard of a couple years ago. He said that didn't work out. I asked him what made Lithia so profitable in the auto industry. He also didn't know why they might be. This man did not work in management, but I was interested in the culture of Lithia and how much a person in sales would know about the corporate situation. We were in Medford, in S. Oregon. As I left town I noticed brand new Lithia facilities, some so new and shiny they hadn't moved in the vehicles to sell.

Today on CNBC there was an interview with a man, Ivan, who is a retired Air Force engineer. He related the story of going to buy a car, I didn't hear where, and the dealership offered him a zero interest loan on the car and $1000 cash back. They needed him to buy the car so much that they offered him a free loan, and paid him to take the loan.

I know, the car is probably overpriced. But that would mean the price of the car needs to come down to be affordable without an interest free loan and the $1000 bribe.

I recall hearing a couple years back that we may be seeing a dangerous rise in CDOs in the bundling of auto loans. I found this article.

I glanced at the Lithia Auto Dealer stock (LAD). The stock topped back in June of last year, has rebounded on lower volume. Not a particularly inspiring chart. It is reminiscent of the housing stocks about eight years ago.

Be careful out there.

gh

Friday, January 30, 2015

Failure To Thrive

Failure to thrive refers to a condition of weight loss or lack of weight gain, particularly in children, as well as a cognitive decline and an apathetic lack of will to live in the elderly. In the elderly patient failure to thrive is often a late stage and terminal condition.

The stock markets remind me of this condition. The averages are not having the sharp rallies that they should when they get to a support area of the past. In the S&P this is the 1990 area. Perhaps the bottom pickers are getting tired of picking higher bottoms.

And the animal spirits are lacking. Recent economic numbers continue to disappoint, the GDP as a measure of U.S. Economic Growth came in slower that the last numbers today. Is the U.S. slowing?

There is no buying down here today. So far. There was some yesterday but the volume was disappointing. The banks continue to hope for higher long term rates, and the yield on the U.S. Treasury bond keeps declining. Despite the political blather it seems the world is ready to loan the U.S. Government money at ever declining rates. They must think we are good for the money. Dollar is strong.....But that is the financial world and sooner or later the stock averages will have to accurately reflect the real economy and will have to come to grips with the fact that demographics in this country and around the world do not favor the kind of "growth" that we came to expect as normal for the last 30 years. That may be a hard nut to swallow.

Standing by.......

gh

NOW: 1125 PST.

gold strong and oil strong..... Is the middle east blowing up??

gh

The stock markets remind me of this condition. The averages are not having the sharp rallies that they should when they get to a support area of the past. In the S&P this is the 1990 area. Perhaps the bottom pickers are getting tired of picking higher bottoms.

And the animal spirits are lacking. Recent economic numbers continue to disappoint, the GDP as a measure of U.S. Economic Growth came in slower that the last numbers today. Is the U.S. slowing?

There is no buying down here today. So far. There was some yesterday but the volume was disappointing. The banks continue to hope for higher long term rates, and the yield on the U.S. Treasury bond keeps declining. Despite the political blather it seems the world is ready to loan the U.S. Government money at ever declining rates. They must think we are good for the money. Dollar is strong.....But that is the financial world and sooner or later the stock averages will have to accurately reflect the real economy and will have to come to grips with the fact that demographics in this country and around the world do not favor the kind of "growth" that we came to expect as normal for the last 30 years. That may be a hard nut to swallow.

Standing by.......

gh

NOW: 1125 PST.

gold strong and oil strong..... Is the middle east blowing up??

gh

Thursday, January 29, 2015

Houston, we have a problem...

The trouble signs are increasing in the worlds markets.....

Stand by.

Rog...

We have the currency valves wide open, but we are still losing pressure here....

Stand by.

Rog...

We have the currency valves wide open, but we are still losing pressure here....

Stand by.

Tuesday, January 27, 2015

Weak Dollar Plays

The averages sharply down in the morning in the U.S.

Economic numbers came in weak.

The Dollar is having a weak day and the weak dollar plays are back on.

Gold, Silver and those miners, even the steel stocks holding up well.

Banks weak again.

Compare EEM to SPY.

Emerging markets holding up well.

I must say though, that from the perspective of a "tape reader" the Vix is not really acting as strong as I would think given the averages. I may be early in a selloff, or...

Control your risk, do something for a change. If it is wrong you can always UNDO it!

gh

Economic numbers came in weak.

The Dollar is having a weak day and the weak dollar plays are back on.

Gold, Silver and those miners, even the steel stocks holding up well.

Banks weak again.

Compare EEM to SPY.

Emerging markets holding up well.

I must say though, that from the perspective of a "tape reader" the Vix is not really acting as strong as I would think given the averages. I may be early in a selloff, or...

Control your risk, do something for a change. If it is wrong you can always UNDO it!

gh

Sunday, January 25, 2015

Where are we?

O'kay. The ECB did the big bond buying thing last week. And the U.S. stock market went up one day and then down. There was no follow through on the long awaited salvation of the world economy.

The conversation seems to be changing evermore to the topic of currency wars and what the endgame may be. The game seems to be accelerating is my feeling. The Chinese yuan made a move a few hours ago that looks to my eye as an out of normal move for that currency, which is normally tightly controlled by the Chinese govt.

And of course the Swiss move the week before last.

And the issue of Dollar strength and it's effects on US exports and spending.

The longer term positive must be low energy prices. IF they stay low. That will depend on how fast the rig count falls in this country and how many drillers go broke before the price rebounds. If money stays cheap the drillers will probably have a chance to prolong the pain. (for themselves) And the consumers and delivery drivers will be happy, but the rebound in energy price would be sharper, presuming that the demand for petroleum products increases.

I continue to think that this may be a sideways to down year. The volatility, so far indicates this. One could just step aside for awhile. Are we counting on that last 5%?

Quite a change from my last post. Was it Mr. Buffet that described Mr. Market as a manic-depressive personality? I feel that way trying to anticipate the herd.

gh

The conversation seems to be changing evermore to the topic of currency wars and what the endgame may be. The game seems to be accelerating is my feeling. The Chinese yuan made a move a few hours ago that looks to my eye as an out of normal move for that currency, which is normally tightly controlled by the Chinese govt.

And of course the Swiss move the week before last.

And the issue of Dollar strength and it's effects on US exports and spending.

The longer term positive must be low energy prices. IF they stay low. That will depend on how fast the rig count falls in this country and how many drillers go broke before the price rebounds. If money stays cheap the drillers will probably have a chance to prolong the pain. (for themselves) And the consumers and delivery drivers will be happy, but the rebound in energy price would be sharper, presuming that the demand for petroleum products increases.

I continue to think that this may be a sideways to down year. The volatility, so far indicates this. One could just step aside for awhile. Are we counting on that last 5%?

Quite a change from my last post. Was it Mr. Buffet that described Mr. Market as a manic-depressive personality? I feel that way trying to anticipate the herd.

gh

Thursday, January 22, 2015

Emerging Markets Outperform

Maria Draghi and the ECB took the plunge and commit to buy assets.

Trillions!

This will continue the "money printing" and will tend to further depress the value of a Euro. The U.S. dollar will continue to gain strength for the time being. The Yen is another question, and it may tend to weigh on the USD as time goes on. The currency war continues.

Energy will, by most accounts, remain weak and cheap for some time. The war between Saudi "overproduction" and the shale revolution in the U.S. and Canada, fueled by cheap money will continue. This is good for consumers and users of oil the world over.

Combine continued easy money with continued cheap energy and it seems to me that you have a potentially explosive mixture. Demand for energy will rise, energy conservation will ease, and activity will increase worldwide. I believe this will be the catalyst for an increase in the velocity of money. The velocity of money has been the factor that has limited the effectiveness of the central bank policies for many years. The velocity of money is the willingness of the horses to pull against the harness. (To reuse a previous analogy)

As the US dollar stays relatively strong, consumption will increase in the US, combined with the cheap energy optimism.

Emerging markets will see increased demand for their exports. These conclusions have been reinforced in the action in the markets lately. See the charts. I think that emerging markets will outperform for the next couple of years. This will be the timeframe for inflation to start to take hold worldwide. After that, all bets are off. But, in the long term......

The charts illustrate the recent relative strength in EEM.

It is important to remember that in the early stages of inflation all assets have the potential to go wildly higher. This includes stocks. We saw this in 2003-2007.

gh

Trillions!

This will continue the "money printing" and will tend to further depress the value of a Euro. The U.S. dollar will continue to gain strength for the time being. The Yen is another question, and it may tend to weigh on the USD as time goes on. The currency war continues.

Energy will, by most accounts, remain weak and cheap for some time. The war between Saudi "overproduction" and the shale revolution in the U.S. and Canada, fueled by cheap money will continue. This is good for consumers and users of oil the world over.

Combine continued easy money with continued cheap energy and it seems to me that you have a potentially explosive mixture. Demand for energy will rise, energy conservation will ease, and activity will increase worldwide. I believe this will be the catalyst for an increase in the velocity of money. The velocity of money has been the factor that has limited the effectiveness of the central bank policies for many years. The velocity of money is the willingness of the horses to pull against the harness. (To reuse a previous analogy)

As the US dollar stays relatively strong, consumption will increase in the US, combined with the cheap energy optimism.

Emerging markets will see increased demand for their exports. These conclusions have been reinforced in the action in the markets lately. See the charts. I think that emerging markets will outperform for the next couple of years. This will be the timeframe for inflation to start to take hold worldwide. After that, all bets are off. But, in the long term......

The charts illustrate the recent relative strength in EEM.

It is important to remember that in the early stages of inflation all assets have the potential to go wildly higher. This includes stocks. We saw this in 2003-2007.

gh

Friday, January 16, 2015

First Solar

FSLR

First Solar has declined from about $70 to $40 with no great increase in the volume. It is odd for a stock price to change that much without some sort of capitulation in sentiment as evidenced by an increase or a spike in volume on the selling. This hasn't happened in this stock. This gives me an indication that there may be a good buying opportunity if the recent trend reverses, and it could be a rapid rise.

I would assume the price action in this stock is predicated on continued profitable business despite the recent and sharp downtrend in the price of energy. The price of oil and gas either does not affect this business, or the holders of this stock think that the price drop of oil and gas is temporary. Or perhaps for other reasons of which I haven't imagined.

But, from a technical perspective I would expect a vigorous rebound if one starts.

Of course this may not be the bottom, and the volume could spike later in a decline.

Control risk,

gh

First Solar has declined from about $70 to $40 with no great increase in the volume. It is odd for a stock price to change that much without some sort of capitulation in sentiment as evidenced by an increase or a spike in volume on the selling. This hasn't happened in this stock. This gives me an indication that there may be a good buying opportunity if the recent trend reverses, and it could be a rapid rise.

I would assume the price action in this stock is predicated on continued profitable business despite the recent and sharp downtrend in the price of energy. The price of oil and gas either does not affect this business, or the holders of this stock think that the price drop of oil and gas is temporary. Or perhaps for other reasons of which I haven't imagined.

But, from a technical perspective I would expect a vigorous rebound if one starts.

Of course this may not be the bottom, and the volume could spike later in a decline.

Control risk,

gh

Thursday, January 15, 2015

Weak Stocks

There was no rally off of support today. There was the beginnings of a rally about an hour before the close, as there usually has been lately, as the buy orders are placed by the funds, but the buying was weak and was met and ultimately overwhelmed by selling into the close of trading, leaving the averages sitting on the recent lows.

Todays news was the surprise move in the Swiss franc precipitated by the Swiss Central Bank announcing that they would no longer keep the Swissie pegged to the Euro. The SF rallied up 20% at the peak of the move, settling up about 14%. If you are a stranger to currency moves let me explain. A 1-2% move in any currency is a big move, so todays move was historic. A few months ago the Swiss had a referendum on the question of whether to require their central bank to buy more gold as a reserve since the Swiss people seemed to be getting tired of their currency declining and the higher prices they had to pay, as well as the usual difficulty saving in your own currency if it is continually debased. Common people understand that at some point the currency becomes worthless and it is a good idea to have some assets that retain some value as a hedge.

This move will surely impact investors around the world. But the story will continue to play out over coming months. Just yesterday a European Supreme Court ruled that it was legal for the European Central Bank to purchase assets on the open markets. This is and will debase the Euro, and the Swiss central bank was in danger of going broke trying to maintain the currency peg. A debased and devalued Euro is thought to be the medicine that will finally stimulate the Euro-zone and give their imports a shot in the arm. It may give the world a shot in the arm as well, as all those cheap Euros are available for worldwide investment. Over the last decades it has been the Yen carry trade, then the US Dollar carry trade, and now the Euro carry trade?

My thoughts are on what a strong US Dollar does for the U.S. It makes imports less expensive so we can consume more imported stuff. But it hurts exports. And exports are how a country gets the cash to spend on the imports, unless it borrows the money. And we aren't in a borrowing mood anymore. Thus the conundrum. A strong dollar also buys more shares of stocks, so the price should come down, and the price of the exporters' stocks will come down if export sales decline. And I don't think that the savers in the U.S. are in favor of doing what the Swiss did today. Their currency went up but their stocks went down. That would not go over well in this country. So we, as a herd will continue to chase the paper prosperity, in the end. When the going gets tough we will demand the easy button.

Another point is that if stimulus is expected to work in Europe, investment money will flow that way, not toward the U.S. as has been the case for some years now.

If these macro events unfold then the U.S. will slow and stocks will continue to weaken and the Federal Reserve will be forced to initially back off of the plan to raise interest rates and ultimately to.......do what? They have interest rates at zero. They have purchased trillions in assets. What could they do next? About the only thing left to do would be to drop cash from helicopters. Mr. Bernanke never got the opportunity to do that, but perhaps Ms. Yellen will. (Google "helicopter Ben")

And this is why, over the long run, assets will hold value and paper will become increasingly worth less.

There is a "race to the bottom" in the world currency markets. Every country in the world wants to put their own people to work by making them competitive. "Competitive" meaning working for less compensation. And the sly way to do this is by making the paper they get paid in worth less.

Here is a price prediction of the next stock declines:

I will probably be wrong. I am about 1/2 the time.

But the danger is increased.

If a wolf was prowling in the neighborhood, I would sound the alarm. Maybe the wolf would just wander away and no harm done. But I want my friends to know when the wolf is around so they can keep the children close to the house. They don't have to keep the kids close if it is too much bother, but at least they know the risks.

Good Day.

Control your risk! Do you get that?

Control your risk.

A wise trader, Richard Russell, said "He who loses the least.................WINS!"

gh

Todays news was the surprise move in the Swiss franc precipitated by the Swiss Central Bank announcing that they would no longer keep the Swissie pegged to the Euro. The SF rallied up 20% at the peak of the move, settling up about 14%. If you are a stranger to currency moves let me explain. A 1-2% move in any currency is a big move, so todays move was historic. A few months ago the Swiss had a referendum on the question of whether to require their central bank to buy more gold as a reserve since the Swiss people seemed to be getting tired of their currency declining and the higher prices they had to pay, as well as the usual difficulty saving in your own currency if it is continually debased. Common people understand that at some point the currency becomes worthless and it is a good idea to have some assets that retain some value as a hedge.

This move will surely impact investors around the world. But the story will continue to play out over coming months. Just yesterday a European Supreme Court ruled that it was legal for the European Central Bank to purchase assets on the open markets. This is and will debase the Euro, and the Swiss central bank was in danger of going broke trying to maintain the currency peg. A debased and devalued Euro is thought to be the medicine that will finally stimulate the Euro-zone and give their imports a shot in the arm. It may give the world a shot in the arm as well, as all those cheap Euros are available for worldwide investment. Over the last decades it has been the Yen carry trade, then the US Dollar carry trade, and now the Euro carry trade?

My thoughts are on what a strong US Dollar does for the U.S. It makes imports less expensive so we can consume more imported stuff. But it hurts exports. And exports are how a country gets the cash to spend on the imports, unless it borrows the money. And we aren't in a borrowing mood anymore. Thus the conundrum. A strong dollar also buys more shares of stocks, so the price should come down, and the price of the exporters' stocks will come down if export sales decline. And I don't think that the savers in the U.S. are in favor of doing what the Swiss did today. Their currency went up but their stocks went down. That would not go over well in this country. So we, as a herd will continue to chase the paper prosperity, in the end. When the going gets tough we will demand the easy button.

Another point is that if stimulus is expected to work in Europe, investment money will flow that way, not toward the U.S. as has been the case for some years now.

If these macro events unfold then the U.S. will slow and stocks will continue to weaken and the Federal Reserve will be forced to initially back off of the plan to raise interest rates and ultimately to.......do what? They have interest rates at zero. They have purchased trillions in assets. What could they do next? About the only thing left to do would be to drop cash from helicopters. Mr. Bernanke never got the opportunity to do that, but perhaps Ms. Yellen will. (Google "helicopter Ben")

And this is why, over the long run, assets will hold value and paper will become increasingly worth less.

There is a "race to the bottom" in the world currency markets. Every country in the world wants to put their own people to work by making them competitive. "Competitive" meaning working for less compensation. And the sly way to do this is by making the paper they get paid in worth less.

Here is a price prediction of the next stock declines:

I will probably be wrong. I am about 1/2 the time.

But the danger is increased.

If a wolf was prowling in the neighborhood, I would sound the alarm. Maybe the wolf would just wander away and no harm done. But I want my friends to know when the wolf is around so they can keep the children close to the house. They don't have to keep the kids close if it is too much bother, but at least they know the risks.

Good Day.

Control your risk! Do you get that?

Control your risk.

A wise trader, Richard Russell, said "He who loses the least.................WINS!"

gh

EEM

Emerging markets stocks and countries have been facing a headwind with the strong dollar and the prospect of an interest raise out of the U.S. Fed.

Now Europe looks set to take over the money printing: Draghi swagger

It is early in the day, but this is what I see in the charts. Emerging markets look strong. Perhaps some firming in oil, and the metals on the prospect of more easy money to come.

Looking at EEM for a change....

gh

And do you remember that vote on gold by the Swiss a few weeks ago, that did not pass. Well perhaps it would pass now.

Not that gold is cost more in Swiss francs, but just to have the safety as the currency wars heats up.

Swiss Central bank shocks

Gold anyone?

Furthermore, the Fed must see now that it would be disastrous to U.S. exporters to proceed with raising interest rates as planned. If we still have a trade deficit, we are not getting wealthier, nor working. Currency war?

Well, it may not be a war with malicious intent. It seems to me it is about the same as the housing bubble and the sale of CDO's. Everybody was doing it, so most banks did it rather than be left behind. Same with worldwide interest rate manipulation. Everybody has to do it, rather than be left behind. That is why it is referred to in polite circles as "competitive devaluation".

The only currency that will be left standing is that solid metal. Gold, copper, silver, palladium. You get the picture.

gh

Now Europe looks set to take over the money printing: Draghi swagger

It is early in the day, but this is what I see in the charts. Emerging markets look strong. Perhaps some firming in oil, and the metals on the prospect of more easy money to come.

Looking at EEM for a change....

gh

And do you remember that vote on gold by the Swiss a few weeks ago, that did not pass. Well perhaps it would pass now.

Not that gold is cost more in Swiss francs, but just to have the safety as the currency wars heats up.

Swiss Central bank shocks

Gold anyone?

Furthermore, the Fed must see now that it would be disastrous to U.S. exporters to proceed with raising interest rates as planned. If we still have a trade deficit, we are not getting wealthier, nor working. Currency war?

Well, it may not be a war with malicious intent. It seems to me it is about the same as the housing bubble and the sale of CDO's. Everybody was doing it, so most banks did it rather than be left behind. Same with worldwide interest rate manipulation. Everybody has to do it, rather than be left behind. That is why it is referred to in polite circles as "competitive devaluation".

The only currency that will be left standing is that solid metal. Gold, copper, silver, palladium. You get the picture.

gh

Wednesday, January 14, 2015

Rock Paper, Scissors.

I am always alert for when any market hits the same level three times. Whether on the way up, or on the way down. The market eventually, most of the time, goes through the triple top/bottom.

The S&P has made a triple low.

Maybe not today. But....

gh

The S&P has made a triple low.

Maybe not today. But....

gh

How IS China Doing?

Markets hit hard today, oil down some more with a surprise inventory report. JNK weak again.

One of the hardest hit is Freeport McMoran (FCX), a copper miner in Australia.

I wonder what this says about the expectation of demand from China.

gh

One of the hardest hit is Freeport McMoran (FCX), a copper miner in Australia.

I wonder what this says about the expectation of demand from China.

gh

Tuesday, January 13, 2015

Et Tu, Banksters?

I will repeat.

Where are the banks?

What is wrong with the banks. Citi still at $5 a share. (You didn't forget that 1/10 split did you?)

If the banks aren't in this stock market party then the punch bowl will not be replenished.

gh

Where are the banks?

What is wrong with the banks. Citi still at $5 a share. (You didn't forget that 1/10 split did you?)

If the banks aren't in this stock market party then the punch bowl will not be replenished.

gh

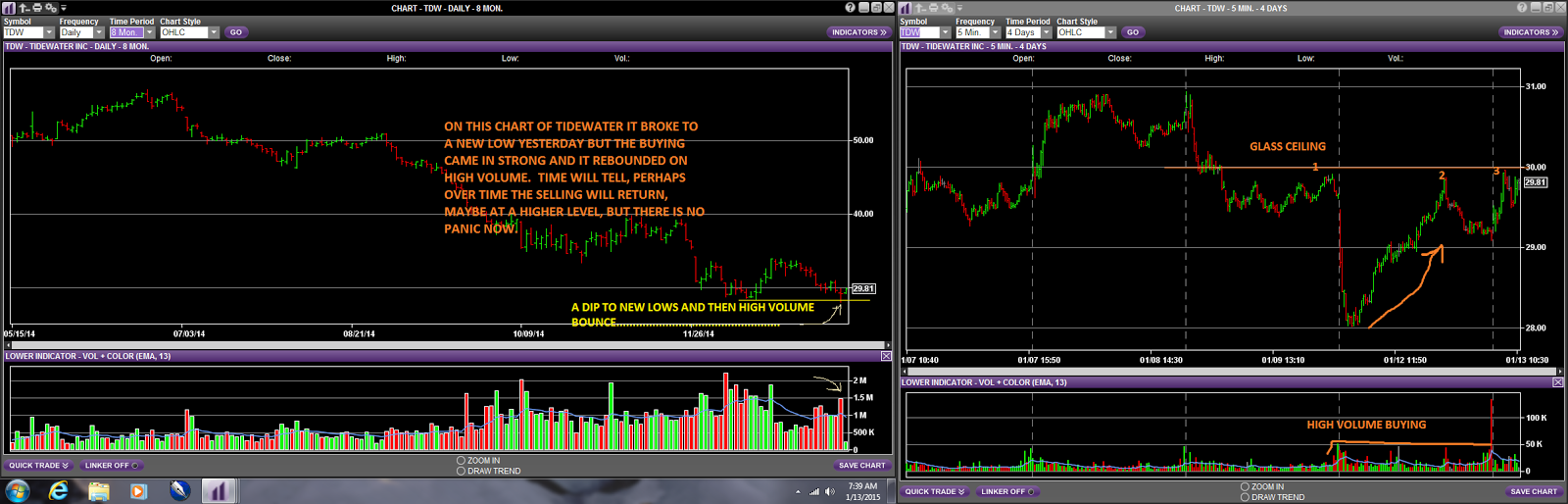

Tidewater

Tide strong the other way today. Lots of shorts getting squeezed by Alcoa earnings coming in strong and talk in Europe of their version of Quantitative Easing, meaning the Eurozone may buy actual assets to keep prices up. Like we did. Everybody's doing it. It's all the rage! (think currency war)

Oil down again, but there seems to be some bottoming going on in some of the drillers and producers. Some may be hedged better than others. Time will tell who will survive and I am not privy to the finances of companies nor do I care to trouble myself at trying to best Warren Buffet at his game. My game is to trade on price, to try to buy low and sell higher, to buy at any price when it seems that the price will move in my favor by the signals that the market is giving in price and volume. The trick is to actually keep your winners for the long term if you are correct at picking a bottom. A trick indeed!

Here is a oil producer that appears to be at a price that some think is value. Time will tell. But for now it is trying to make a bottom in price.

control risk,

gh

Oil down again, but there seems to be some bottoming going on in some of the drillers and producers. Some may be hedged better than others. Time will tell who will survive and I am not privy to the finances of companies nor do I care to trouble myself at trying to best Warren Buffet at his game. My game is to trade on price, to try to buy low and sell higher, to buy at any price when it seems that the price will move in my favor by the signals that the market is giving in price and volume. The trick is to actually keep your winners for the long term if you are correct at picking a bottom. A trick indeed!

Here is a oil producer that appears to be at a price that some think is value. Time will tell. But for now it is trying to make a bottom in price.

control risk,

gh

Monday, January 12, 2015

Somethin' happenin' here

There IS something happening. I don't know what it is in particular. But, when I get this feeling from what the various markets are doing it is often a correct interpretation. My most memorable was on the week before 9/11 2001.

Perhaps not.

But here is a tune to ease your mind:

Watch that sign....

Perhaps not.

But here is a tune to ease your mind:

Watch that sign....

"Pullback"

"U.S. stock markets will experience a pullback from their record highs at the end of February, according to David Kostin, Goldman Sachs' chief U.S. equity strategist, who believes that fund managers have become too bullish on the market."

"The U.S. equity markets are likely to experience a pull-back some time in the next 4-6 weeks and that would be pretty consistent with the magnitude of an extreme reading we see in the commodities futures trading corporation data," he told CNBC Monday.

Kostin here

A pullback "consistent with the extreme reading" .......

gh

"The U.S. equity markets are likely to experience a pull-back some time in the next 4-6 weeks and that would be pretty consistent with the magnitude of an extreme reading we see in the commodities futures trading corporation data," he told CNBC Monday.

Kostin here

A pullback "consistent with the extreme reading" .......

gh

JNK NOT Weak

JNK, as a representative of the junk bond market is NOT weak this morning with stocks selling off early, and gold holding up while the miners surge.

Oil is down sharply, but the point with JNK is that this may be the bottom in oil, and the top in the USDollar.

gh

I must add: "so far!"

Oil is down sharply, but the point with JNK is that this may be the bottom in oil, and the top in the USDollar.

gh

I must add: "so far!"

Sunday, January 11, 2015

Soybeans

Soybean prices as a predictor of weak U.S. dollar?

The striking thing about the beans is the chart pattern, a rising triangle as a bottom formation. One of my favorites by the way.

But I've noticed similar patterns in the gold miners also. Kind of...

And some of the other currencies are in a range, particularly the Japanese Yen.

It is about time for some respite from the "King Dollar" story for awhile. Some doubt must be allowed to fall.

gh

The striking thing about the beans is the chart pattern, a rising triangle as a bottom formation. One of my favorites by the way.

But I've noticed similar patterns in the gold miners also. Kind of...

And some of the other currencies are in a range, particularly the Japanese Yen.

It is about time for some respite from the "King Dollar" story for awhile. Some doubt must be allowed to fall.

gh

Friday, January 9, 2015

What Could Happen?

The US stock market rally, and the rally in the US dollar has been predicated on a strong US economy, and weakness around the world. We have ignored the weakness around the world, perhaps thinking we are continuing beneficiaries of American exceptionalism. Whatever the hell that is.

The markets are worried that the sharp decline in the price oil will destabilize the junk bond markets due to the debts taken on by shale oil and gas producers. But over the last weeks we seem to have rationalized that perhaps we can get by with any oil price around $50. And we get greedy over all those new dollars in peoples pockets that they will surely use to buy extra gadgets at Walmart.

But the whole thing is predicated on an economy that continues to grow, however slowly. What if that ain't so? Hidden in the employment numbers today, strong though they were, was that little thing about a lack of wage increases. If wages aren't going up, even a little, where is the demand for workers.

However it turns out. I am struck by the coincidence of the US Dollar starting it's clime last summer at exactly the same time that oil commenced it's own decline. What does the oversupply of oil have to do with the US Dollar strength. Particularly when demand for oil worldwide is reportedly not strong.

Perhaps someone can tell me the answer. It is probably simple. But it seems to me that it is altogether possible that oil is indeed part of a slowdown in the works, worldwide, not to exclude the Exceptional Americans.

Ignorantly yours,

gh

The markets are worried that the sharp decline in the price oil will destabilize the junk bond markets due to the debts taken on by shale oil and gas producers. But over the last weeks we seem to have rationalized that perhaps we can get by with any oil price around $50. And we get greedy over all those new dollars in peoples pockets that they will surely use to buy extra gadgets at Walmart.

But the whole thing is predicated on an economy that continues to grow, however slowly. What if that ain't so? Hidden in the employment numbers today, strong though they were, was that little thing about a lack of wage increases. If wages aren't going up, even a little, where is the demand for workers.

However it turns out. I am struck by the coincidence of the US Dollar starting it's clime last summer at exactly the same time that oil commenced it's own decline. What does the oversupply of oil have to do with the US Dollar strength. Particularly when demand for oil worldwide is reportedly not strong.

Perhaps someone can tell me the answer. It is probably simple. But it seems to me that it is altogether possible that oil is indeed part of a slowdown in the works, worldwide, not to exclude the Exceptional Americans.

Ignorantly yours,

gh

Thursday, January 8, 2015

PetroBras?

Is this "THE" bottom in PBR?

Only time will tell. It acts like it may be one. For awhile....

Use caution. Scale in for a long trend change.

gh

Only time will tell. It acts like it may be one. For awhile....

Use caution. Scale in for a long trend change.

gh

Where Are the Banks?

Big rally in the indexes so far today. Undoubtedly a lot of short covering going on. Yet gold is holding up, so far.

But where are the banks. They are up in price, but I do not see the volume in the rally. Maybe later.

If you look at the price of the banks most of the big ones have gone NOWHERE since last fall. And the regional banks are worse.

I am looking for a rollover in the indexes near the end of the day....

We'll see.

control risk,

gh

But where are the banks. They are up in price, but I do not see the volume in the rally. Maybe later.

If you look at the price of the banks most of the big ones have gone NOWHERE since last fall. And the regional banks are worse.

I am looking for a rollover in the indexes near the end of the day....

We'll see.

control risk,

gh

Wednesday, January 7, 2015

1/7/15

Stock market averages up in the morning.

JNK as a representative of junk bonds up as well, but not so much volume. Volume is what matters. Perhaps the volume will come later. But not so far today.

The selloff in the junk bonds has been related to the plunge in the price of oil and the fact that a great many of the high yield corporate bonds are from the oil producers, explorers, drillers. It is uncertain how long the price of oil will stay low, or how low it may go due to Saudi production and world overproduction and lack of demand. And that uncertainty translates into uncertainty regarding the viability of companies in the earl bidness.

gh

JNK as a representative of junk bonds up as well, but not so much volume. Volume is what matters. Perhaps the volume will come later. But not so far today.

The selloff in the junk bonds has been related to the plunge in the price of oil and the fact that a great many of the high yield corporate bonds are from the oil producers, explorers, drillers. It is uncertain how long the price of oil will stay low, or how low it may go due to Saudi production and world overproduction and lack of demand. And that uncertainty translates into uncertainty regarding the viability of companies in the earl bidness.

gh

Tuesday, January 6, 2015

AU

I am looking for a bottom in Agnico, as well as many of the gold and silver miners. Low energy will help with production costs and any slowing of the world economy will give another reason to print money worldwide.

Why not? This time may be different!

Control your risk. If a trade costs you more than a few percent on a small initial position, let it go. Trade the trend. Bottom picking is an exercise in catching the change in trend. It is an exercise in timing. In the case above, IF the price holds in this low range I will hold an initial 1/3 position. IF it breaks out above this range I will add another 1/3. And will consider more after a subsequent consolidation and a continuation higher. Then I will play it by ear. I think this stock has a good chance to make it to $15 in the next few weeks. How it gets there will determine my action from there.

control your risk,

gh

Why not? This time may be different!

Control your risk. If a trade costs you more than a few percent on a small initial position, let it go. Trade the trend. Bottom picking is an exercise in catching the change in trend. It is an exercise in timing. In the case above, IF the price holds in this low range I will hold an initial 1/3 position. IF it breaks out above this range I will add another 1/3. And will consider more after a subsequent consolidation and a continuation higher. Then I will play it by ear. I think this stock has a good chance to make it to $15 in the next few weeks. How it gets there will determine my action from there.

control your risk,

gh

A Respected Voice

Bill Gross, the former head of Pacific Investment Management (PIMCO), the largest bond fund in the world, who left his former employer to go to Janus Funds has some sobering and to my way of thinking, commonsense advice for investors. When he left PIMCO there was talk of his abrasive style with employees, and, frankly, some talk of his grip on reality. I suspect his views on the future may not have been consistent with the views of the largest bond fund in the world. After 35 years of a bond bull market, or any long term bull market for that matter, attitudes become entrenched and investment advice becomes rote. This is the phenomenon that eventually puts "everyone" on the same side of the trade, and causes the massive dislocations in finance and economies with the unwind.

Gross may be right on the immediate future. That future for the next couple years. The action in the bond market, specifically US treasuries, and interest rates in Europe for the last few months have not been congruent with an economic recovery. Of course we have known for some time that the EU is in trouble, and the troubles keep recurring, think of Greece. But the hope has been that the U.S. economy would continue to be strong and eventually pull the rest of the world up with US. This has been a source of recent strength in the USD, and weakness in the other major currencies. Not to mention the intentional devaluations in other major nations and currencies, thinking of Japan recently and China for years.

But the world is facing headwinds that even zero interest rate policies may not overcome. First to mind is the demographic challenges on the order of the baby boom in the western world and most of Asia. And the large debt burdens of many countries must resolve eventually.

Timing is everything. I trade flexible positions but am always on alert for the direction of the markets in general. Such being a function of "sentiment" which is a complex amalgam of positions in place as well as outlook for the future.

The recent action in the precious metals, even with the recent strength in the US Dollar, may be a presentiment for the future. Whether that means US Dollar weakness in the future, or just another round of weakness for all currencies and flight to safety.

Listen to Mr. Gross:

William Gross

Monday, January 5, 2015

Visit Jesse

You don't need to hear what I have to say.

Visit Jesse

Jesse's Cafe......

When the other currencies of the world start to hold some value, the US Dollar is going to take a beating. And those things priced in the USD (worlds "reserve" currency) will require many more USD to be acquired. The day gets closer.

gh

Visit Jesse

Jesse's Cafe......

When the other currencies of the world start to hold some value, the US Dollar is going to take a beating. And those things priced in the USD (worlds "reserve" currency) will require many more USD to be acquired. The day gets closer.

gh

Friday, January 2, 2015

Subscribe to:

Comments (Atom)